Getting a Construction Loan is the First Financing Step Toward Building Your New Home

A construction loan is temporary financing to pay for the cost of construction when you don't have all the cash. It usually comes from a bank, and is limited to a percentage of the total cost.

Typically an interest-only loan, it has a limited life (usually 12 months). The loan can be renewed or extended under certain conditions. Each month you will owe the bank the interest for the month. Additional payments cannot be made to pay down the loan balance of a construction loan. It must be paid off all at once at the end of construction with cash or with a home mortgage loan.

See the link at the end of this page for practical advice for managing your construction loan.

Working With The Bank

Your first step will be to select a bank. Banks are cautious about loaning construction money to owner builders who are not in the home building business. Don't be surprised if the banker gives you a thorough grilling about your experience in building. The bank wants to feel confident that you will run a successful project - especially that you will succeed financially. And remember - visit more than one bank if necessary. Don't give up!

A local banker told us of a house his bank financed, where the builder failed financially during the project. Since the construction financing includes a mortgage on the property, the bank became the owner. The bank began the difficult task of finding a home builder who was willing to take over and complete the house. The rear portion was built on dirt fill which wasn't properly compacted,and that area of the house settled severely. The fix was to either jack up the rear of the house, or demolish and rebuild the whole thing! Catastrophes such as this have led banks to be more cautious with construction financing.

Banks and their government regulators have tightened loan practices due to the lending disasters that recently occurred throughout the United States. Do your homework and have a good plan for building and for managing the money!

Do We Have To Tell The Bank Everything?

Well, pretty much. Some folks seem to think that banks have an obligation to loan them money and help them out, but getting a loan is a privilege, not a right. The bank will have to feel really good about you to loan you tens of thousands of dollars (or hundreds of thousands). Be cooperative, and expect a lot of questions and forms, including these:

1. A bank appraisal based on your property and the drawings for your new home.

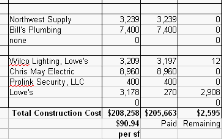

2. A good estimate of the expected construction cost.

3. A Credit Report ordered by the bank to determine your credit history and credit worthiness or risk.

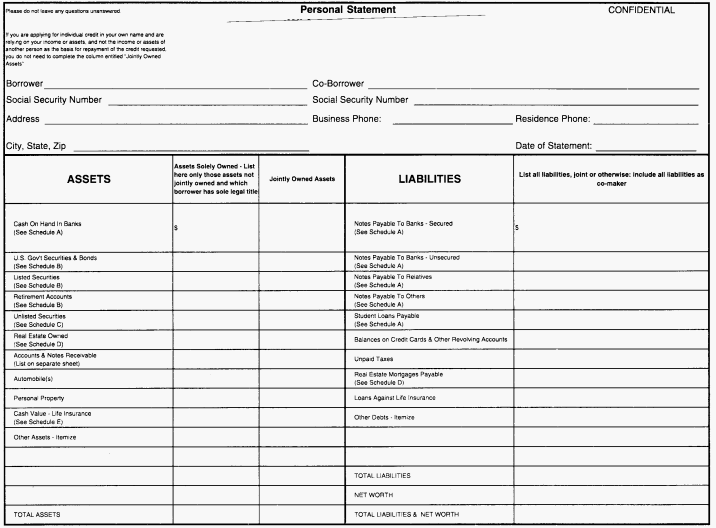

4. A Loan Application, which will include spaces for you to calculate your net worth, income and expenses, including required documentation.

5. A separate Financial Statement may be required by some banks, usually on their form. See a portion of a bank's form below:

How Much Can We Borrow?

Until mid-2008, you could usually get a construction loan for up to 80% of the appraised value. Due to the nationwide loan crisis, you can expect banking regulations to require borrowers to put more cash into home projects than previously required. These loans may now be limited to 80% of the actual cost of the house and property. Since the actual cost is usually significantly lower than the appraised value, this will result in a large reduction in allowable loan amounts.

You will work with your banker to determine the loan amount. This can include the value of the property, which can be rolled into the construction loan.

Develop a good relationship with the banker - he'll be one of your most valuable assets!

Insurance

You will have to get a Builder's Risk Insurance Policy to close the construction loan with the bank. This insurance protects you and the bank from losses due to theft or damage to the house during the construction period. The policy terminates automatically when you move into the house, so be sure you have a homeowner's policy in force before you move.

Practical advice on managing your construction loan.

Return from Construction Loans page to Building Loans page.

Comments

Have your say about what you just read! Leave us a comment or question in the box below.