Understanding the Amortization Schedule for a Home Mortgage

The amortization schedule, or table, lists the costs of every monthly mortgage loan payment, breaking down the amounts for principal, interest, and balances owed.

On this page we will look at what the figures and columns mean – it's not as complicated as it looks.

We'll also look at whether or not you should pay off your loan early, and why adjustable rate mortgages are such bad deals.

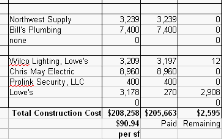

After you've used the construction loan to get through the building of your new home, you will probably need a home mortgage. The construction loan cannot be paid down – it can only be paid off. This interest-only loan will be paid off at the final mortgage loan closing. The new loan will be a “mortgage” loan, meaning the house and property become mortgaged security, or collateral, that you offer the lender in exchange for receiving the loaned money to pay off the construction loan. You guarantee the lender that you will pay the money back on schedule, and the lender guarantees that he will take possession of your property if you don't.

The closing attorney or financing institution should give you an amortization schedule at closing, consisting of 4 to 8 pages. If they don't, you can print your own from several web sites for free. We like Bankrate.com. Click here to open their amortization schedule calculator page.

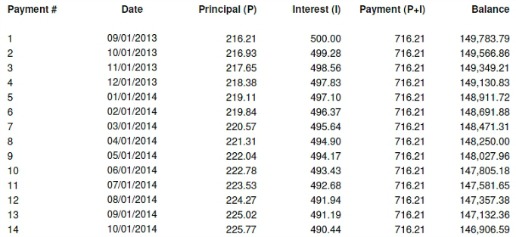

Here, we'll use an example of a $150,000 loan with a term of 360 months (30 years), at a fixed rate of 4% interest (annual rate). The monthly payment calculates to $716.21. Here's the beginning of the amortization schedule, or table:

Notice with a fixed interest rate, the payment is always the same. At each payment, the remaining Balance is multiplied by the 4% interest to give a year's interest. Divide that by 12 months, and you have the interest portion for the next month's payment. The remainder of the $716.21 payment is principle, which is the amount applied to paying off the loan.

In the Interest column, notice the amount of interest decreases with each monthly payment. Since each month's interest is based on the loan balance at that time, the interest you owe each month gets less and less, and the remaining principle portion gets higher and higher.

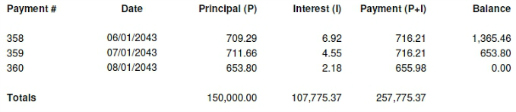

The end of the amortization schedule is shown above. As you can see, the total interest paid over the loan is significant. The mortgage interest can give you a tax deduction. The amount saved on your income taxes will be a percentage of the interest paid, but NEVER THE ENTIRE AMOUNT!

“No one would think that,” you say. Well then, you'd be surprised at how many people actually think the “government” pays you back for all the interest you pay. Never has been so, and never will be.

I had a college-educated coworker who insisted that this was so – that when you “deduct the interest from your taxes,” you actually save the entire amount of interest. Neither of us would give in to the argument, so he called the accountant who prepared his tax returns. The accountant told him the truth - only a portion of the amount is deducted.

Simply calculated, using our sample amortization schedule, an assumed federal tax rate of 20% (varies with your taxable income), plus Alabama's 5% tax rate:

1st Year's interest = $5,952 (will be deducted from your taxable income)

Federal tax saving = $1,190

State tax saving = $ 298

Your tax savings for that year would be $1,488.

Should I try to pay extra on my house payments, which I've heard will reduce the loan balance faster?

Yes. Paying extra on your home loan will save interest. For example, if at Payment 4 above you could pay an extra $200, the $497.83 interest remains the same, but the principle paid that month would jump to $418.38. That has no impact on the interest charged for that month, and but the loan balance is reduced by the entire extra $200.

Even if you sell your house after a few years, never paying off the loan, you'll get back the additional principle amounts that you paid in. The loan balance you have to pay off at the sale will be that much smaller than it would have been if you hadn't paid any extra.

One disadvantage to paying extra is that you might lose the use of the extra money for investments that would bring a better return on the extra money than the rate of interest you are paying on the home loan. Also, if you have an adjustable rate mortgage, it's very difficult to make decent progress on paying off the loan early. This is just one of several reasons that they are crummy deals. See our comments below about this.

You have to answer the following question for yourself:

Is your house a purchase or an investment? Your answer will make the difference in how you treat paying off the loan, and should be part of your overall plan for managing your finances.

Why you should never get an adjustable rate mortgage if you want to pay off your loan early -

Since the interest rate is adjustable within certain limits, usually once a year. Adjusting the interest rate always changes your monthly payment. When you pay extra principle, those amounts do reduce the loan balance. The bad news is, at the end of each year the loan is recalculated with the new interest rate to set the next year's monthly payment. This calculation is based on paying off the loan for the remaining number of years – there is no consideration for cutting payments off the loan the way you do with a fixed-rate loan.

Check the figures and you will find that the new year's monthly payment is less than it would have needed to be to cut time off the loan. An adjustable rate mortgage's terms are not arranged to allow you to pay off the loan early with extra monthly or yearly amounts. We learned this the hard way.

Susan and I wish you the very best with managing the building of, and paying for, the home of your dreams!

Sincerely,

Vic Hunt

Go from Amortization Schedule page to Cost and Loans page.

Comments

Have your say about what you just read! Leave us a comment or question in the box below.